Ready to uncover the secret behind explosive growth, disruptive ideas, and once-in-a-lifetime opportunities? Every year, countless startups light up the business world with game-changing solutions and bold visions. For investors, this is where dreams meet dollars, and where backing the right idea can turn into the success story of the decade.

Investing in startups isn’t just about returns; it’s about riding the wave of innovation and becoming part of the next big thing. At our upcoming business event, the Founders 2.0 Conference, we are bringing together leading experts and visionary founders to share insights, spark fresh ideas, and spotlight the most promising opportunities in the startup world. The business summit takes you inside the trends and strategies shaping the next wave of success stories. Let’s explore why investing in startups is essential for every entrepreneur and investor seeking a competitive edge.

Startups are engines of innovation that can deliver extraordinary returns. Unlike mature companies, they’re nimble and quick to pivot, often capturing opportunities others miss. They embrace experimentation and adapt swiftly to changing market conditions. This dynamic approach helps them stay ahead of the curve and redefine what’s possible.

Experts at our business event will highlight how startups thrive on innovation, creativity, and fresh business models that fuel rapid growth. For investors, this means a chance to ride the wave of success and be part of something transformative.

Why this matters:

Being part of this journey isn’t just financially rewarding; it’s an opportunity to witness and contribute to the evolution of industries.

While traditional investments like stocks and bonds remain essential, startups bring a refreshing dynamism to any portfolio. They open doors to emerging industries and sectors that often go unnoticed by mainstream markets, allowing investors to tap into innovation and growth. Startups can operate independently of broader economic trends, offering a buffer against market volatility and ensuring a more balanced investment mix.

Experts will share how exposure to startups helps investors stay ahead of the curve by connecting them with the latest industry shifts and technologies. Our upcoming business event offers a space to discover new opportunities, build networks, and learn from investors who have navigated similar paths. The Founders 2.0 Conference further deepens this experience, providing insights that help investors make informed decisions and confidently diversify their portfolios for a future-ready investment strategy.

Startup investing isn’t just about funding, it’s about being part of the story. Investors often have the chance to guide and influence the growth of the companies they support. This active involvement can be advantageous, as it gives investors a sense of ownership in the startup’s success.

Unlike passive investments, where you simply watch from the sidelines, startup investing invites you to be an active participant. You can share expertise, help founders navigate challenges, and play a role in shaping strategies that propel the company forward. This influence not only strengthens your investment but also builds meaningful connections.

What makes influence so valuable?

Investing in startups is about leaving a lasting impact on the business world and contributing to meaningful change.

Source: FasterCapital

The startup ecosystem thrives on collaboration and connection. By investing in startups, you gain access to a vibrant community where ideas flourish, relationships are built, and opportunities multiply. Being part of this network brings rewards beyond financial returns, offering opportunities to share experiences, learn from others, and explore new trends that keep you at the forefront of innovation.

Attending our business event can open doors to valuable interactions with experts who share insights, offer fresh perspectives, and spark collaborations that fuel both your investments and the growth of the startups you support. These events turn your investment journey into a shared experience within a vibrant, supportive network.

Investing in startups is more than a financial choice, serving as a journey that develops you as an investor, leader, and lifelong learner. It challenges you to think differently, stay adaptable, and embrace the unknown.

Startups operate in a world where change is constant, and this environment pushes you to develop resilience, curiosity, and an entrepreneurial mindset. You learn to spot opportunities, assess risks, and pivot when necessary, gaining skills that serve you not just in investing but in life as a whole.

Personal growth opportunities:

This journey turns you into more than an investor, shaping you into a champion of innovation and progress.

Investing in startups is about more than financial returns. It means supporting visionary founders, embracing fresh ideas, and helping shape the industries of tomorrow. Whether you are new to investing or an experienced entrepreneur, the startup ecosystem offers countless opportunities to grow, learn, and make an impact.

Our upcoming entrepreneur summit is the perfect place to meet inspiring founders, gain valuable insights, and discover the next big opportunity. Our Founders 2.0 Conference brings together experts and passionate investors who share a commitment to progress. Bring your curiosity, your vision, and your enthusiasm. The future belongs to those who invest in it.

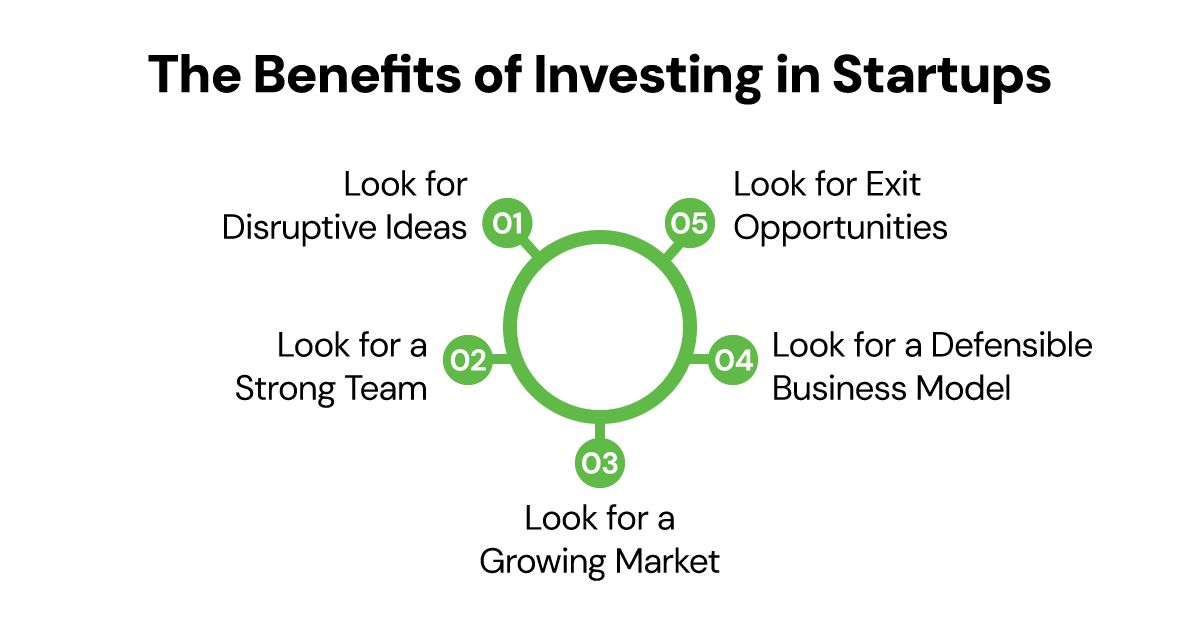

Q. What types of startups should entrepreneurs focus on investing in?

A. Entrepreneurs should look for startups with innovative solutions in high-growth industries like AI, fintech, clean energy, and health tech. These sectors are often at the forefront of technological disruption and have strong long-term potential.

Q. How can entrepreneurs evaluate a startup’s team before investing?

A. Look for a strong founding team with relevant experience, adaptability, and a clear vision. Assess their track record, team dynamics, and culture fit, as these factors often determine a startup’s success.

Q. How can attendees prepare to make the most of the Founders 2.0 Conference?

A. Attendees should research the speakers and sessions in advance, set clear networking goals, and bring business cards or digital contact information.

Q. What key themes will the Founders 2.0 Conference explore this year?

A. The conference will spotlight innovation, startup growth, disruptive technologies, and investment opportunities. Attendees can expect sessions on funding strategies, scaling businesses, and building winning teams.

Q. How long should entrepreneurs expect to hold their investments in startups?

A. Startup investments typically require a long-term horizon, often 5–10 years. Exits can occur through acquisitions or initial public offerings (IPOs), but patience and a strategic outlook are crucial.

Posted on : Wed, 11/05/2025 - 15:48

Posted on : Thu, 11/06/2025 - 16:26

Posted on : Fri, 09/26/2025 - 15:26

Posted on : Wed, 09/24/2025 - 16:18

Posted on : Wed, 09/24/2025 - 16:18

Posted on : Fri, 08/08/2025 - 16:41

Posted on : Thu, 07/31/2025 - 18:18

Posted on : Fri, 07/25/2025 - 20:07

Posted on : Tue, 07/01/2025 - 19:04

Posted on : Thu, 06/26/2025 - 15:09